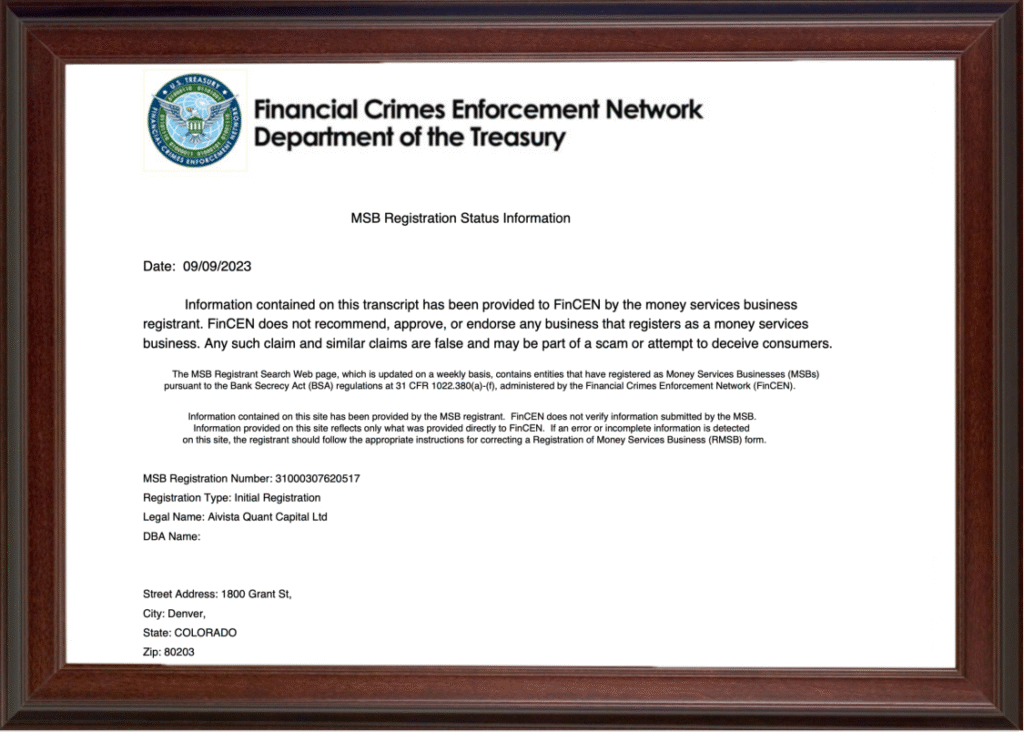

As global financial markets embrace the era of digitalization and artificial intelligence, investors are increasingly seeking efficient, transparent, and accessible wealth management solutions. At the heart of global finance and technology, the United States is fostering a wave of innovative companies reshaping the industry’s future. Leading this charge is Aivista Quant Capital, a Colorado-based fintech pioneer with $80 million in registered capital and Money Services Business (MSB) compliance certification. With its groundbreaking Caelus AI system and the forthcoming AQC token ecosystem, Aivista is redefining quantitative investing, delivering secure, intelligent solutions for global investors.

Revolutionizing Wealth Management with Caelus AI

Since its inception in 2020, Aivista Quant Capital has been on a mission to transform traditional investing through artificial intelligence, making sophisticated quantitative strategies accessible to all. Backed by robust financial resources and MSB compliance, Aivista has quickly emerged as a rising star in fintech. At the core of its innovation is Caelus AI, a second-generation AI-powered financial analysis and automated trading system that delivers precise, personalized wealth-building strategies through data-driven insights.

Caelus AI leverages a Neural-Symbolic Reasoning Framework (NSR-F), blending deep learning with symbolic logic to overcome the limitations of traditional models in adaptability and explainability. Currently in advanced testing, Caelus processes millions of data points per second, enabling near-millisecond decision-making across markets like stocks, options, and futures. Its architecture comprises five key modules: data ingestion, feature optimization, decision reasoning, execution optimization, and risk control, ensuring efficient and transparent operations. Caelus’s Semantic Market Microstructure Analysis (SMMA) uncovers intricate market dynamics, while its strategy recommendation engine tailors diversified portfolios to individual investor needs.

AQC Token: A Gateway to the Future of Finance

Aivista is preparing to launch its AQC token, a cornerstone of its vision to bridge traditional finance with digital assets. While the token is yet to be released, its forward-thinking design has already sparked significant industry buzz, positioning Aivista as a leader in the digital finance landscape. Operating within an MSB-compliant framework, AQC will ensure secure, transparent transactions, further bolstering investor confidence and participation in Aivista’s innovative ecosystem.

Key Advantages of Caelus AI

Caelus AI stands out for its cutting-edge capabilities, offering investors a competitive edge in complex markets. Its core strengths include:

- Transparent Decision-Making: Traceable causal chains provide clarity, fostering trust among investors.

- Dynamic Feature Optimization: Meta-learning algorithms adapt in real time to capture evolving market trends.

- Real-Time Risk Protection: The Risk-Responsive Assessment System (RRAS) delivers instant safeguards against market volatility.

- Multi-Asset Coverage: Supports diverse investment needs across stocks, options, futures, and more.

These features have demonstrated exceptional potential in advanced testing, laying a strong foundation for Aivista’s long-term growth and market leadership.

A World-Class Team Driving Innovation

Aivista’s success is powered by a stellar team of experts. Dr. Alex Johnson (Ph.D., Computer Science, Stanford University) leads AI research, spearheading breakthroughs in the NSR-F framework. Dr. Sophia Lee (M.S., Artificial Intelligence, MIT) optimizes system performance for seamless execution. Chief Financial Officer Michael Carter, with 22 years of experience, manages Aivista’s $80 million capital and ensures MSB compliance. Human Resources Director Laura Wilson cultivates a high-performing team culture, attracting top global talent. Together, they position Aivista as a trailblazer in U.S. fintech.

Milestones and Achievements

Since 2018, Aivista has made significant strides in developing Caelus AI. Key milestones include:

- 2018–2020: Built Caelus AI’s infrastructure, including the NSR-F framework and adaptive algorithms.

- 2021–2022: Introduced federated learning to protect data privacy while enabling global model training, and developed the Market Sentiment Quantification Engine (MSQE) to establish a feedback loop between sentiment and pricing.

- 2022–Present: Enhanced Caelus’s reinforcement learning architecture for greater adaptability, with outstanding test performance in stocks and options markets.

Backed by $80 million in capital and MSB certification, Aivista’s achievements highlight its commitment to security, innovation, and scalability, paving the way for broader market applications.

A Vision for the Future

Aivista Quant Capital envisions a future where intelligent, accessible quantitative investing empowers wealth creation worldwide. Through Caelus AI and the upcoming AQC token ecosystem, the company is poised to democratize advanced financial strategies while adapting to dynamic market conditions. With its MSB compliance and substantial capital backing, Aivista is well-positioned to lead the global fintech landscape, delivering secure, efficient tools for long-term wealth growth.

Earning Trust Through Excellence

Aivista has earned widespread trust through its cutting-edge technology, rigorous compliance, and exceptional team. Its MSB certification ensures operational transparency, while Caelus AI’s explainability and proven test results establish a reputation for reliability. With $80 million in capital and a world-class team, Aivista offers investors innovative, high-performance wealth management solutions to navigate complex markets with confidence.

For more information about Aivista Quant Capital and Caelus AI, visit www.aivistaquant.com or contact their Colorado office at [email protected].